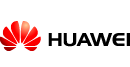

Challenges Faced by Commercial Banks

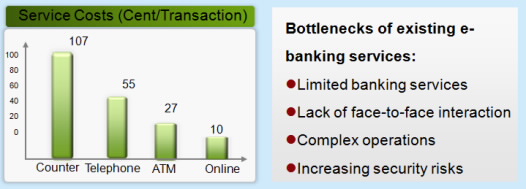

Retail banks are the service foundation of commercial banks whose major concerns are how to quicken branch construction, raise revenues, and improve customer satisfaction. Commercial banks are facing a variety of challenges as follows:

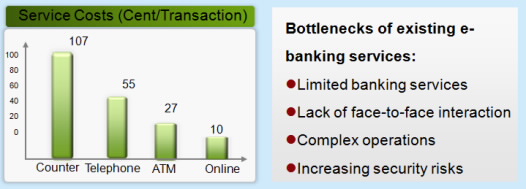

Huawei eSpace Virtual Teller Machine (VTM) remote banking solution fuels banks' innovation engine by leveraging Huawei's unmatched voice and video communication technologies. eSpace VTM offers customers immediate banking services 24 hours a day and provides an enjoyable high-definition (HD) face-to-face video experience. As a result of these performance capabilities, eSpace VTM frees banks from major bottlenecks.

eSpace VTM Solution

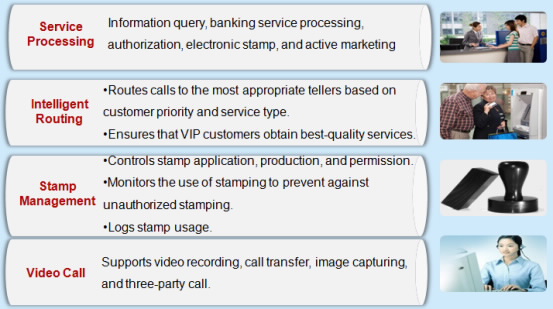

eSpace VTM allows customers to process banking services under the assistance of remote tellers, which substantially reduces retail banking expenses and brings forth innovative breakthroughs to remote banking services.

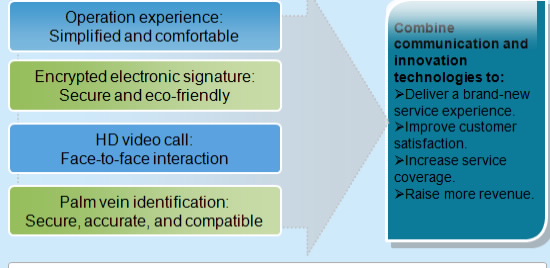

VTM solution supports these functions: savings, intermediate service, financial planning, information query, paying, and account opening.

Product portfolio

Application Scenarios of VTM Terminals

eSpace VTM Terminal Introduction

VTM terminals support industry standards design and delivery capabilities.

The VTM1000 is a space-saving integrated vertical terminal.

The VTM2000 offers a soothing and comfortable service environment equipped with modern interior design furniture and a large screen.

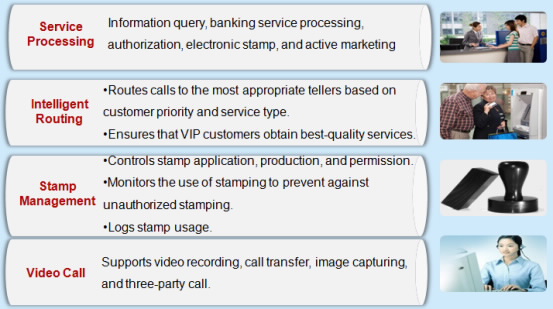

eSpace VTM Service Center

Face-to-face lifelike service experience:

Leverages HD video technologies to enable face-to-face and real-time interaction with customers.

Uses desktop sharing and push to greatly improve service efficiency.

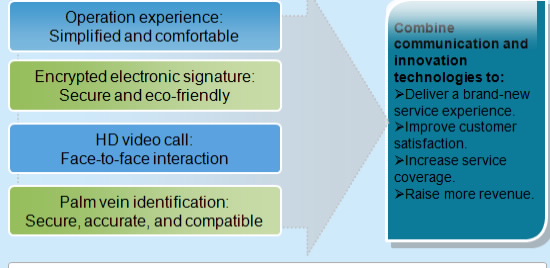

eSpace VTM Solution Features

Diversified Services

- Diversified banking services to alleviate service pressure in retail banks

- User-friendly design to ensure better customer experience

- Security options to lower transaction risks

Face-to-Face Interaction

- Low bandwidth yet high-quality video call

- Low operation and maintenance costs

- Video recording and transaction traceability

Active Marketing

- VIP customers first served

- Advertisement push

- Desktop sharing and information push

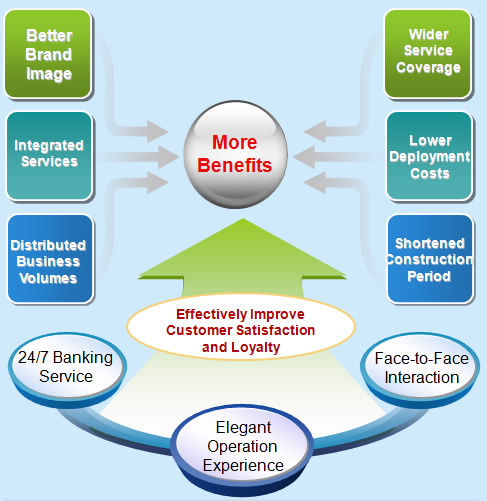

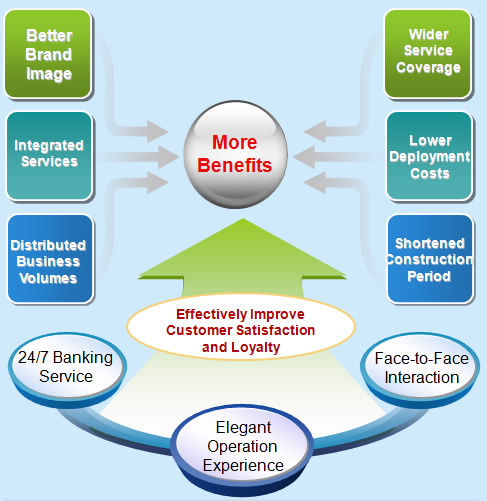

eSpace VTM Benefits

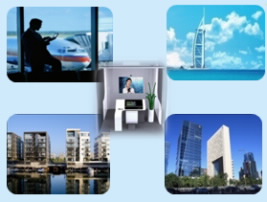

eSpace VTM Application Scenarios

Bank Branch + VTM Self-Service Zone

Location: Self-service zones in retail banks

Benefits: Distributed business volumes; Low transaction costs

Bank Branch +VIP Service Zone

Location: VIP service zones in retail banks

Benefits: Attracting more VIP customers with best-quality services

24/7 Self-Service Zone + VTM

Location: 24/7 self-service banks

Benefits: Low transaction costs; 24/7 service

Enterprise Campus

Location: Enterprise campuses where VTM terminals can be deployed independently

Benefits: Shortened construction period; Wide service coverage; 24/7 service

Airport, Office Building, Hotel, and Suburb

Benefits: Widens banking service coverage; Protects customers' privacy and safeguards financial account information.

High-End Residential Community

Benefits: Attracts high-end customers with a comprehensive portfolio of financial services.

Frees high-end customers from highly complex financial products and investment figures.

Mobile VTM: VTM terminals are mounted on vehicles or in temporary facilities to provide convenient and secure customer services.

Benefits: Provides first-response and on-demand banking services; Promotes brand image of banks.