China Construction Bank (CCB) has successfully set up and put into operation next-generation IT systems that meet the bank’s business growth and strategic transformation needs and underpin the operations of the bank’s key financial services such as financial management, financial markets, and risk control services. This move by CCB is crucial to shifting from a traditional management model to a digital, enterprise-class management model. It’s also a key initiative in reforming financial systems and represents a worldwide role model for Banking 4.0.

By Jin PanshiGeneral Manager, IT Management Department, China Construction Bank

Strategies Come First: Five Strategic Transformations Pay Off

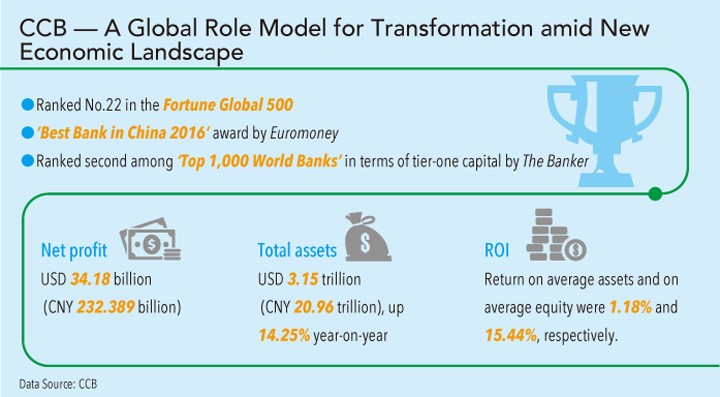

China Construction Bank reported a fruitful year in 2016. According to its annual results, CCB’s total assets amounted to around USD 3.15 trillion (CNY 21 trillion), net profit reached approximately USD 34.18 billion (CNY 232.4 billion), and returns on average assets and average equity were 1.18 percent and 15.44 percent, respectively. The bank out-performed most of its rivals in terms of market value and key indicators. CCB also won over 100 industry awards from well-known organizations both at home and abroad in 2016, including the ‘Best Bank in China 2016’ award from Euromoney. In 2016, the bank placed second in the ‘Top 1,000 World Banks’ in terms of tier-one capital by The Banker, and 22nd in the ‘Fortune Global 500.’

The global economic situation has changed dramatically in recent years; interest rate liberalization, new financial regulations, external environments, financial innovation, and other emerging factors have had a huge impact on the entire finance industry. Despite a complex economic environment, CCB achievements have been impressive. The reason is that, in 2010, CCB started to change and transform itself to adapt to the fast-changing market. For example, the bank announced initiatives to build next-generation IT systems and create a new technology and finance ecosystem.

Driven by technical innovations, CCB has coordinated and united bank-wide resources to first clarify the ‘as-is’ and ‘to-be’ services, then adopt an enterprise-class methodology to streamline all services, products, and data and, finally, reinvent systems with new architectures and standards. CCB is dedicated to becoming one of the most valuable and creative banks in the world. To this end, CCB has accelerated its transformation in the following five ways:

-

Integration

CCB has integrated a variety of processes, including customer information, employee management, general ledger, pricing management, and product management processes onto a single platform. This integration provides a solid foundation for enhancing comprehensive business operations. A 360-degree customer profile and deep data mining create more new business opportunities. Customer-centric ideas are fully implemented, including marketing activities, innovative products, and services. A bank-wide framework helped us build an enterprise-class platform across CCB’s worldwide offices, including parent companies and small subsidiaries, to support global and integrated development.

-

Multi-Functional Services

CCB has built a multi-functional platform that revolves around a finance ecosystem, and has reshaped dozens of key service systems (such as custody, financial markets, payment, and settlement systems). By doing so, CCB can provide customers with a holistic set of improved financial services characterized by flexible combinations and customizations. The bank also streamlined the entire transaction chain, which contributed to the building of a better finance ecosystem. Big Data technology has been applied in the bank to facilitate operations and management decision-making. Typical applications have been ‘pushed’ to customers by means of precision-marketing approaches. An in-depth analysis of customers’ behavioral dynamics helps generate marketing data. We can then push differentiated advertisements to them, enabling the bank to achieve the best marketing outcomes.

-

Intensive Development

CCB has transitioned to an intensive production paradigm for counter services at bank branches by separating the foreground and background systems. This new paradigm has transformed the production model from siloed, serial, one-by-one service processing to parallel and streamlined service processing. As a result, the period of each corporate settlement handling is shortened from 5 minutes to 2 minutes, the acquisition of personal credit cards is accelerated from the industry average of 15 days to 7 days, the identity review and approval efficiency is increased by 20 times, and labor costs are reduced by over 5 times. This transformation improves service-handling efficiency, reduces operating costs, improves user experience, and mitigates the transaction processing pressure faced by bank branches.

-

Innovative Bank

CCB constructed a product assembly factory with relevant, agile R&D mechanisms. These implementations are used in CCB’s 14 product lines and 136 basic products and help to quickly launch customized, salable products that support fast service innovation and growth.

CCB also introduced ‘DragonPay,’ its flagship payment product. The DragonPay product is convenient, simple, and extremely popular. This innovative payment product covers all online and offline scenarios and integrates near field communication, QR codes, and other technologies for the first time. Its major functions include ‘CCB Wallet,’ QR code payment, all-card payment, cloud-based quick payment, free withdrawals, payment by friends, AA payment, and Dragon Business Owner.

-

Intelligent Bank

CCB has removed bank-wide channel barriers and set up a holistic, collaborative, and intelligent channel system. This new system provides anytime, anywhere, and on-demand financial services and delivers consistent user experience in multiple scenarios, paving the way for an intelligent bank system. As part of the system, Intelligent Teller Machines (ITMs) provide customers with one-stop, self-service, intelligent, diversified service experience. About 60,000 ITMs have been installed to support approximately 200 non-cash services. Up to 67 percent of counter services are diverted to ITMs. Benefits include reduction of labor costs, improved productivity, and new channels for product sales and customer service support. In the near future, the new model of ‘customer self-service as the major way; bank teller service as a supplementary way’ will gain momentum. CCB has also introduced a smart online robot. The robot has handled more than 1.2 billion service requests, with over 5 million daily interactions (equivalent to the workload of 10,000 agents/attendants). The robot’s response accuracy rate is 93 percent — a great improvement in efficiency that significantly reduces costs.

Bold Transformation and Innovation: Enterprise-Class IT Construction Plays a Pivotal Role

CCB adopted a bold, far-sighted, coordinated, and global approach to implement mission-critical strategies. CCB’s achievements would have been impossible without the strong support of next-generation digital IT systems that include service, technology, and implementation transformation. Two keywords — ‘enterprise-class’ and ‘model-based’ — best describe CCB’s transformation.

-

Service Transformation

CCB adopted an industry-leading enterprise-class methodology to conduct service transformation. First, CCB carried out strategic planning by sorting out bank-wide services, data, and products. In doing so, CCB built a service value chain that involved all operations and management. Based on its transformation strategies and five-year plan, CCB finalized 26 service priorities and over 100 service components that established a bank-wide service framework. Then, CCB conducted enterprise-class modeling and enriched the service framework. This standardized, structured approach streamlined service processes, data, and products to accommodate both current and future needs. Finally, CCB designed and developed an IT architecture based on the modeling results.

-

Technology Transformation

Technology transformation established a holistic IT architecture based on service modeling results. Composed of 12 platforms in 7 layers, the IT service-oriented architecture features components, platforms, and loose coupling. It is stable, flexible, parameterized, and scalable. A distributed structure is adopted for the overall system, while a centralized structured is used for key applications. This ‘centralized and distributed’ converged architecture provides advantages such as strong security, stability, reliability, simple management, high cost-effectiveness, massive concurrency, and powerful processing capabilities. Moreover, CCB built the largest private cloud in the finance industry in China and constructed an economical, reliable, elastic, and universal cloud infrastructure that adapted to the Internet’s tidal business model in order to rapidly roll out bank products.

-

Implementation Transformation

Implementation transformation indicates that strict, full-lifecycle implementation techniques for IT system construction have been developed to regulate the input, output, references, and roles in all stages by each project team. A next-generation enterprise-class implementation management system has been established. The biggest benefit of the IT full-lifecycle management system includes central management of data during the entire process, from project feasibility studies and initiation, to requirement, analysis, design, encoding, test, migration, production, and O&M.

A comprehensive transformation of a huge banking group like China Construction Bank is as difficult as replacing the engine of an airplane in flight. Thanks to the unremitting efforts of all CCB staff in the last six years and the support of leading ICT vendors inside and outside of China, including Huawei, CCB has built next-generation, industry-leading IT systems. In the future, CCB will continuously improve its omnichannel technology and finance ecosystem that not only are ‘smart,’ but also beneficial to all. Through this ecosystem, CCB can provide customers with on-demand financial services anytime, anywhere, offer all bank branches convenient, considerate, professional, and reliable marketing tools, and pave the way for rapid development of the entire banking group.

More Case Studies

- Major French Banking Group BPCE Chooses Huawei as One of Its Technology Partners

- HSBC puts partnership and data at the heart of digitalization

- Accelerating FinTech Innovation Facilitates ICBC’s Transformation and Development

- China Insurance Giant CPIC Leads in the Digital Era

- How China Everbright Bank Chose Huawei FusionCube to Build a Converged Architecture Resource Pool

(0 scores)

Like the story? Give your score.

0/500

0comments

You have scored successfully.

You have submitted successfully.

Evaluation failed.

Submission failed.

Please write your comment first.